Open Banking Report 2018

By Holland Fintech, Finovate

From the report, ““Open Banking is an opportunity to serve customers across segments in an even better manner by co-creating services to meet their needs”, rightfully noted Jarkko Turunen of Nordea in The Papers’ 2017 edition of the Open Banking and API report. Open Banking is about creating opportunities and helping users achieve their ambitions, further agreed Derek White of BBVA, who indicated that opening the bank’s platform to third party applications meant “creating synergies with the most innovative tech businesses out there in order to build a new generation of digital experiences for customers that are as convenient and advantageous as possible”. Very well received by readers, our comprehensive last year’s edition of our Open Banking report showcased the nascent landscape of Open Banking in Europe and the issues standing at that moment in the way of universal adoption. We made our best efforts to shed light on the functional scope of access to account, effective business and operational models, and standardisation in terms of technology, legal, and operational matters. Even more, The Paypers gave an overview of the key issues that come with open access, by asking crucial players in the market such as banks, consultants, merchants, and fintechs to give more insights into the debate and the most relevant topics that need to be addressed and solved in order to fully leverage the potential of Open Banking. And, of course, we explored the strategic implications this initiative has for banks and the changes that it will bring for product creation and distribution. Also, we provided a synopsis of what the new regulations put forward by PSD2 will entail and how can these be adopted and implemented by the banking industry”

Tags

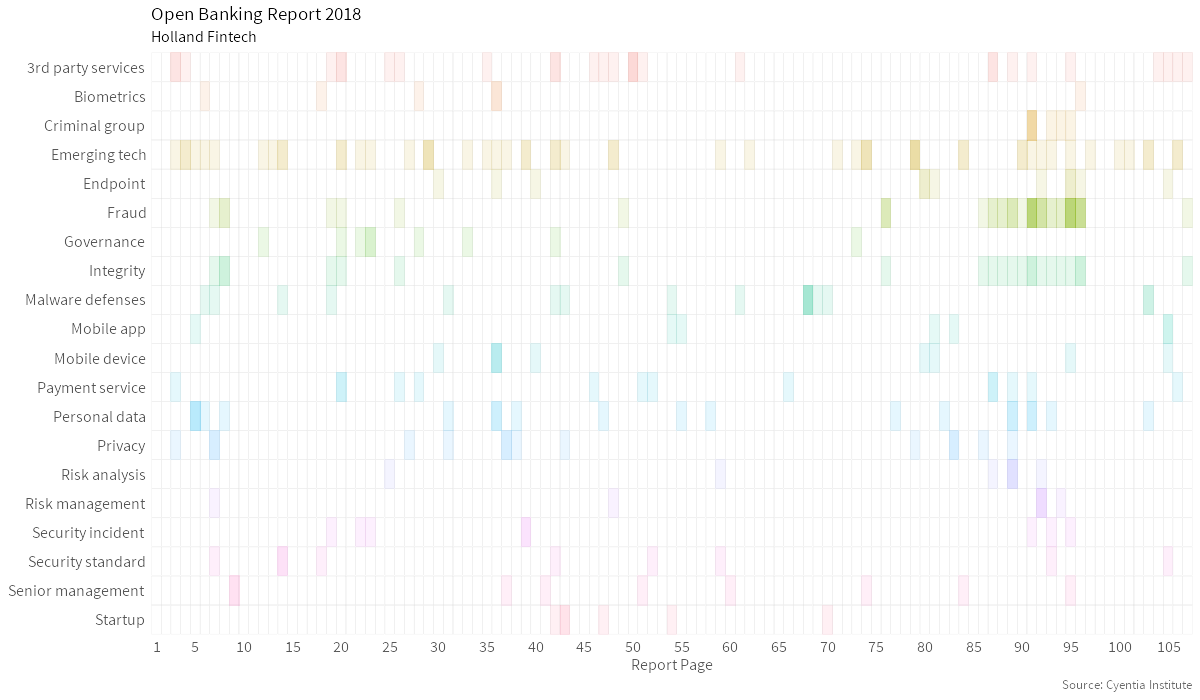

Emerging Tech Fraud 3rd Party Services Integrity Personal Data Malware Defenses Payment Service Privacy Endpoint GovernanceTopic Map